We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Here's Why You Should Add Zions (ZION) Stock to Your Portfolio

Read MoreHide Full Article

Zions Bancorporation (ZION - Free Report) is well-positioned for growth on the back of a solid loan balance and higher interest rates. Hence, adding the stock to your portfolio now seems a wise idea now.

The Zacks Consensus Estimate for ZION’s 2024 and 2025 earnings have been revised upward by 1.4% and 2.2%, respectively, over the past 30 days, indicating that analysts are optimistic regarding its earnings growth potential. The company currently carries a Zacks Rank #2 (Buy).

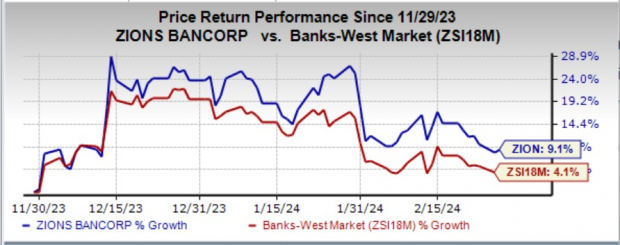

Over the past three months, the company’s shares have gained 9.1% compared with the industry’s growth of 4.1%. Image Source: Zacks Investment Research

Now, let’s discuss some of the important factors that make ZION stock worth a look.

Revenue Strength: Zions has experienced a consistency in revenue growth with a compound annual growth rate (CAGR) of 2.3% over the last five years ended 2023. This was driven by robust loan growth, with loans and leases (net of unearned income and fees) witnessing a CAGR of 4.4% over the last four years (2019-2023). Steady loan demand, the company’s efforts to improve fee income and higher interest rates are expected to continue supporting top-line growth.

Due to the tough operating environment, we project total revenues (FTE) to decline 3.9% in 2024. However, the metric is expected to rise 4.4% and 4.9% in 2025 and 2026, respectively. Our estimates for total loans suggest witnessing a CAGR of 2.3% over the three years ended 2026.

Driven by higher rates, the net interest margin (NIM) is likely to keep improving while rising funding costs will exert some pressure. While NIM declined in 2023, we expect the metric to have a positive impact in the near future. We project NIM to be 3.02%, 3.22% and 3.37% in 2024, 2025 and 2026, respectively.

Earnings Growth: ZION’s earnings have witnessed growth of 12.13% over the past three to five years. The company’s earnings are projected to decline 10.9% in 2024, while it will rebound and grow 5.2% in 2025.

Impressive Capital Distribution: Zions has an impressive capital distribution plan. The company has been paying out dividend to its shareholders regularly. In July 2022, the bank announced an 8% hike in quarterly dividend to 41 cents per share and has maintained the payout ever since. The company has five-year annualized dividend growth of 6.84% and a payout ratio of 34% of earnings.

The company has a solid share repurchase program in place. The company bought back 0.9 million shares in 2023. In February 2024, the bank authorized a share repurchase plan worth $35 million for the year. Despite not expecting large amounts of share repurchases in the immediate future, the company is anticipated to sustain efficient capital distributions supported by a robust capital position and lower dividend payout ratio compared with peers.

Stock Seems Undervalued: Zions has Price/Cash Flows and Price/Earnings (F1) of 6.36 and 7.91 compared with the industry’s Price/Cash Flow and Price/Earnings (F1) of 7.49 and 12.95, respectively. The stock has a Value Score of A. Our research suggests that stocks with a Style Score of A or B, when combined with Zacks Rank #1 (Strong Buy) or 2, offer the highest upside potential.

Other Bank Stocks to Consider

Northrim BanCorp, Inc.’s (NRIM - Free Report) 2024 earnings estimates have increased 7.8% over the past 30 days. Shares of NRIM have climbed 14.2% over the past six months. At present, NRIM sports a Zacks Rank #1. You can seethe complete list of today’s Zacks #1 Rank stocks here

BayCom Corp.’s (BCML - Free Report) 2024 earnings estimates have remained unchanged over the past 30 days. Shares of BCML have gained 2.8% in the past six months. Currently, BCML carries a Zack Rank #2.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Shutterstock

Here's Why You Should Add Zions (ZION) Stock to Your Portfolio

Zions Bancorporation (ZION - Free Report) is well-positioned for growth on the back of a solid loan balance and higher interest rates. Hence, adding the stock to your portfolio now seems a wise idea now.

The Zacks Consensus Estimate for ZION’s 2024 and 2025 earnings have been revised upward by 1.4% and 2.2%, respectively, over the past 30 days, indicating that analysts are optimistic regarding its earnings growth potential. The company currently carries a Zacks Rank #2 (Buy).

Over the past three months, the company’s shares have gained 9.1% compared with the industry’s growth of 4.1%.

Image Source: Zacks Investment Research

Now, let’s discuss some of the important factors that make ZION stock worth a look.

Revenue Strength: Zions has experienced a consistency in revenue growth with a compound annual growth rate (CAGR) of 2.3% over the last five years ended 2023. This was driven by robust loan growth, with loans and leases (net of unearned income and fees) witnessing a CAGR of 4.4% over the last four years (2019-2023). Steady loan demand, the company’s efforts to improve fee income and higher interest rates are expected to continue supporting top-line growth.

Due to the tough operating environment, we project total revenues (FTE) to decline 3.9% in 2024. However, the metric is expected to rise 4.4% and 4.9% in 2025 and 2026, respectively. Our estimates for total loans suggest witnessing a CAGR of 2.3% over the three years ended 2026.

Driven by higher rates, the net interest margin (NIM) is likely to keep improving while rising funding costs will exert some pressure. While NIM declined in 2023, we expect the metric to have a positive impact in the near future. We project NIM to be 3.02%, 3.22% and 3.37% in 2024, 2025 and 2026, respectively.

Earnings Growth: ZION’s earnings have witnessed growth of 12.13% over the past three to five years. The company’s earnings are projected to decline 10.9% in 2024, while it will rebound and grow 5.2% in 2025.

Impressive Capital Distribution: Zions has an impressive capital distribution plan. The company has been paying out dividend to its shareholders regularly. In July 2022, the bank announced an 8% hike in quarterly dividend to 41 cents per share and has maintained the payout ever since. The company has five-year annualized dividend growth of 6.84% and a payout ratio of 34% of earnings.

The company has a solid share repurchase program in place. The company bought back 0.9 million shares in 2023. In February 2024, the bank authorized a share repurchase plan worth $35 million for the year. Despite not expecting large amounts of share repurchases in the immediate future, the company is anticipated to sustain efficient capital distributions supported by a robust capital position and lower dividend payout ratio compared with peers.

Stock Seems Undervalued: Zions has Price/Cash Flows and Price/Earnings (F1) of 6.36 and 7.91 compared with the industry’s Price/Cash Flow and Price/Earnings (F1) of 7.49 and 12.95, respectively. The stock has a Value Score of A. Our research suggests that stocks with a Style Score of A or B, when combined with Zacks Rank #1 (Strong Buy) or 2, offer the highest upside potential.

Other Bank Stocks to Consider

Northrim BanCorp, Inc.’s (NRIM - Free Report) 2024 earnings estimates have increased 7.8% over the past 30 days. Shares of NRIM have climbed 14.2% over the past six months. At present, NRIM sports a Zacks Rank #1. You can seethe complete list of today’s Zacks #1 Rank stocks here

BayCom Corp.’s (BCML - Free Report) 2024 earnings estimates have remained unchanged over the past 30 days. Shares of BCML have gained 2.8% in the past six months. Currently, BCML carries a Zack Rank #2.